ACH Routing Number

Peak’s routing number is

325181015

It's also printed along the bottom of your checks.

Account Number versus Member Number

- Your account number is between 9 to 14 digits, and used to identify an individual checking, savings, or other account. It’s the number other financial institutions request when completing direct deposit and payment forms.

- Your member number is between 5 to 6 digits, and used to identify a group of accounts shared by the same owners. It's often used when contacting Peak.

Finding your account number

-

Log in to online banking or the mobile app

-

Your account number is displayed under the account name on the home page.

- Also view it by selecting your account, and choosing “details and settings”.

- It will be 9 to 14 digits such as “000654321” or “10900000654321”.

Finding your member number

- Your member number by itself is not used for direct deposits or payments.

- It’s printed in the upper-right corner of your statement.

- To access your statements online, login to online banking and select “Documents” in the navigation heading, then select “Statements”.

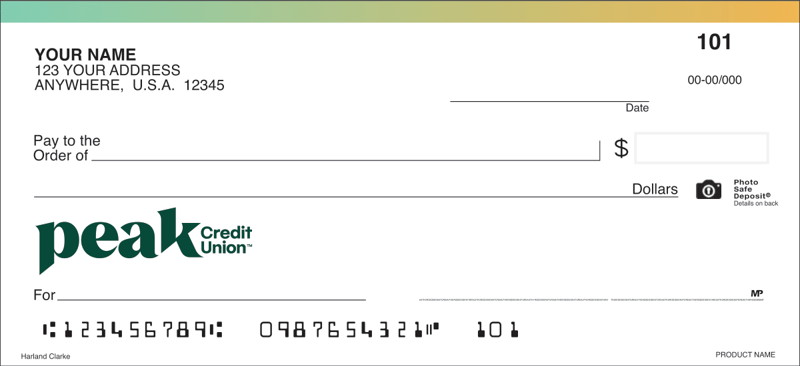

Finding your full checking account number on the bottom of your Peak check

There are three sets of numbers across the bottom of your Peak check. The first set of numbers is Peak’s routing number (325181015), the second set of numbers is your full checking account number, and the third set of numbers will match the check number that is located in the top right hand corner of your check. When setting up your ACH or direct deposit you will need:

- Peak’s routing number (325181015). The first set of numbers on the bottom of the check.

- Your full checking account number. The second set of numbers on the bottom of the check.

One of the most common questions we hear is “What is Peak’s routing number?”

Peak members look for the routing number -- also called an ABA number -- to set up an automatic payment using the Automated Clearing House (ACH) system.

ACH transactions are commonly used for direct deposits or for automatic payments from your account. ACH credits come from employers and government agencies. ACH payments go to insurance companies, utilities, telephone companies, and more.

Who, or what, is behind this efficient, reliable and secure method of payment exchange?

It’s a not for profit organization called the National Automated Clearing House Association (NACHA). They oversee the ACH network, which is one of the largest payment systems in the world.

Try it for yourself -- it’s easy!

If you would like to set up a direct deposit of your paycheck, ask your employer if they can set up an ACH transfer. They may already have a form available.

If you receive Social Security or unemployment you can sign up for direct deposit on their websites. You can also get tax refunds with ACH; just include your account number and routing number on your 1040!

If you have a recurring payment with a fixed amount, you can establish an ACH transfer from your account. The recipient of your payment can tell you how to set up an ACH transfer with their company.

You also have access to Peak’s free Bill Payer service to set up payments. With Bill Payer, you are in control over when and how much money is sent to your various vendors.